Tesoro sancionó a ciberactores nigerianos que atacan a EE.UU.. Hoy, en una acción coordinada con el Departamento de Justicia de los Estados Unidos, la Oficina de Control de Activos Extranjeros (OFAC) del Departamento del Tesoro tomó medidas contra seis ciudadanos nigerianos por llevar a cabo un elaborado plan para robar más de seis millones de dólares a las víctimas en todo el Reino Unido y EE.UU.

Antilavadodedinero / Treasury.gov

Las personas designadas hoy se dirigieron a empresas e individuos estadounidenses a través de amenazas globales engañosas conocidas como compromiso de correo electrónico comercial (BEC) y fraude romántico.

Los ciudadanos estadounidenses perdieron más de $ 6,000,000 debido a los esquemas de fraude BEC de estas personas, en los que se hicieron pasar por ejecutivos de negocios y solicitaron y recibieron transferencias bancarias de cuentas comerciales legítimas. El dinero también fue robado a estadounidenses inocentes por fraude romántico, en el cual los designados se hicieron pasar por socios afectuosos para ganarse la confianza de las víctimas.

«Los cibercriminales se aprovechan de los estadounidenses vulnerables y las pequeñas empresas para engañarlos y defraudarlos», dijo el secretario Steven T. Mnuchin. «A medida que el avance tecnológico ofrece cada vez más herramientas de actores maliciosos que se pueden utilizar para ataques y esquemas en línea, Estados Unidos continuará protegiendo y defendiendo a los estadounidenses y las empresas en riesgo».

Los actores maliciosos están explotando la mayor disponibilidad de herramientas y tecnología en línea para atacar a los estadounidenses en riesgo.

Las seis personas designadas hoy manipularon a sus víctimas para obtener acceso a los nombres de usuario, contraseñas y cuentas bancarias para promover el esquema. Varios de los que se dedicaron al fraude romántico usaron herramientas en línea, incluidas las redes sociales y el correo electrónico, para promover sus tácticas de ingeniería social.

Documento de laq OFAC

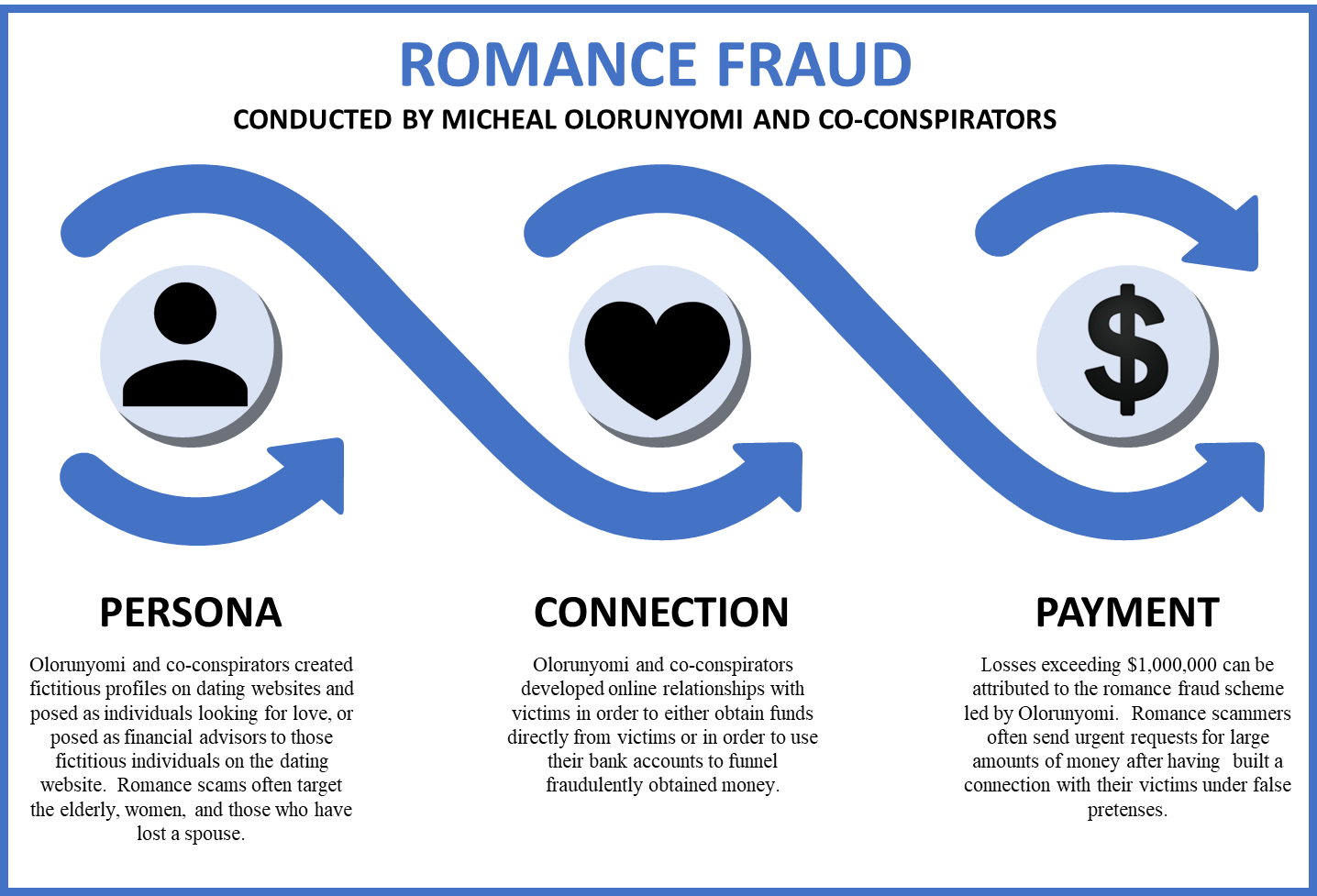

OFAC closely coordinated with the Federal Bureau of Investigation (FBI), which today released details regarding its indictment against members of the conspiracy. The FBI Internet Crime Complaint Center (IC3) receives romance fraud victim reports from all ages, education, and income brackets. However, the elderly, women, and those who have lost a spouse are often targeted.

E.O. 13694 SANCTIONS

Today’s action includes the designation of six individuals pursuant to Executive Order (E.O.) 13694, as amended by E.O. 13757, which targets malicious cyber-enabled activities, including those related to the significant misappropriation of funds or economic resources for private financial gain.

As a result of today’s action, all property and interests in property of the designated persons that are in the possession or control of U.S. persons or within or transiting the United States are blocked, and U.S. persons generally are prohibited from dealing with them.

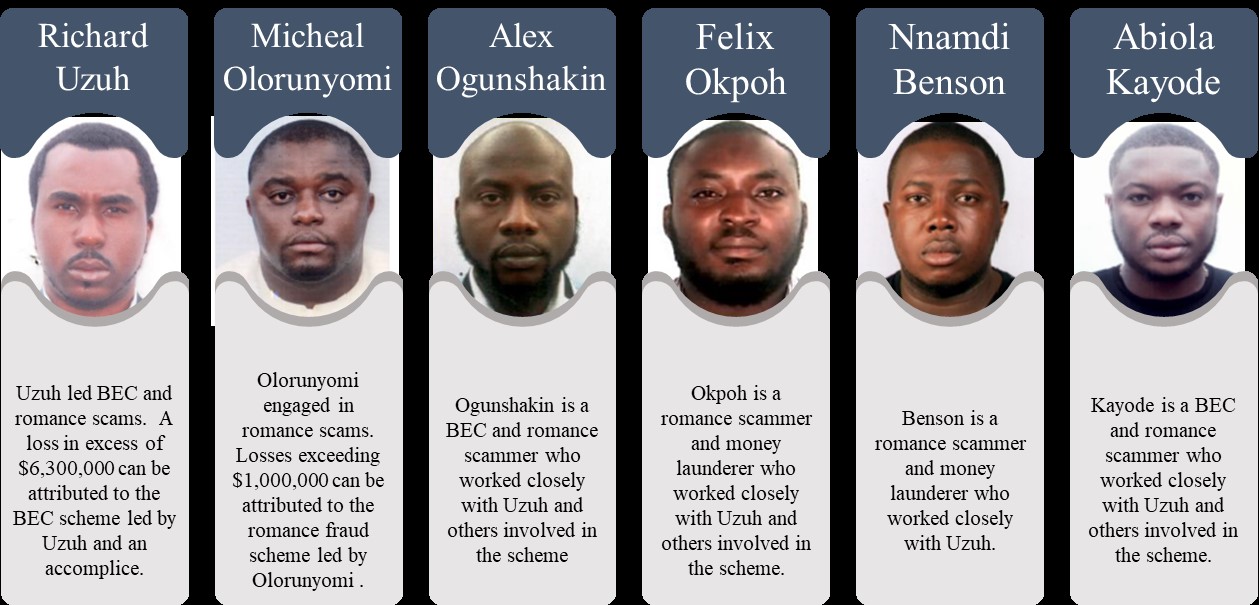

Richard Uzuh (Uzuh) was designated pursuant to E.O. 13694, as amended, for having engaged in cyber-enabled activities that have the purpose or effect of causing a significant misappropriation of funds or economic resources for private financial gain.

From at least early 2015 to September 2016, Uzuh and an accomplice sent emails to victims appearing as though they were coming from a company’s true business executive, and would request and receive wire transfers of funds from the businesses’ accounts. Uzuh would often target over 100 businesses in a single day. A loss in excess of $6,300,000 can be attributed to the BEC scheme led by Uzuh and an accomplice.

Micheal Olorunyomi (Olorunyomi) was designated pursuant to E.O. 13694, as amended, for having engaged in cyber-enabled activities that have the purpose or effect of causing a significant misappropriation of funds or economic resources for private financial gain.

From September 2015 to June 2017, Olorunyomi and an accomplice led a scheme that victimized Americans through the use of romance fraud. Olorunyomi and his co-conspirators created fictitious profiles on dating websites and posed as individuals looking for love. He developed online relationships with victims to either obtain funds directly from victims, or used their bank accounts to funnel fraudulently obtained money. Losses exceeding $1,000,000 can be attributed to the romance fraud scheme led by Olorunyomi and his accomplice.

Alex Ogunshakin (Ogunshakin) was designated pursuant to E.O. 13694, as amended, for having provided financial, material, or technological support for Uzuh.

Ogunshakin conducted BEC and romance scams. Ogunshakin provided Uzuh and other co-conspirators with bank accounts that were used to receive fraudulent wire transfers. Additionally, Ogunshakin assisted Uzuh with contacting victim companies and he conducted his own BEC schemes.

Felix Okpoh (Okpoh) was designated pursuant to E.O. 13694, as amended, for having provided financial, material, or technological support to Uzuh.

Okpoh conducted romance scams and engaged in money laundering, working closely with Uzuh and others involved in the scheme. Okpoh provided hundreds of U.S. bank accounts that were used to receive fraudulent wire transfers from victims of BEC and romance fraud.

Nnamdi Benson (Benson) was designated pursuant to E.O. 13694, as amended, for having provided financial, material, or technological support to Uzuh.

Benson conducted romance scams and money laundering, working closely with Uzuh. Benson communicated with multiple romance fraud victims to obtain their bank account details, and provided the account information to Uzuh to receive fraudulent wire transfers from U.S. businesses.

Abiola Kayode (Kayode) was designated pursuant to E.O. 13694, as amended, for having provided financial, material, or technological support to Uzuh.

Kayode conducted BEC and romance scams, working closely with Uzuh and others involved in the scheme. Kayode provided U.S. bank accounts to individuals involved in the scheme, one of which was then used to receive a $69,150 fraudulent wire transfer.

Identifying information on the individuals and entity designated today.

Treasury is committed to responding to evolving online threats that target organizations and individuals in the United States. In July 2019, Treasury’s Financial Crimes Enforcement Network (FinCEN) released an advisory noting that it received over 32,000 reports involving almost $9 billion in attempted theft from BEC fraud schemes targeting U.S financial institutions and their customers since its 2016 advisory. In another ongoing effort, recovered funds through FinCEN’s Rapid Response Program, in collaboration with law enforcement, recently surpassed $920 million. Under the program, when U.S. law enforcement receives a BEC complaint from a victim or a financial institution, the relevant information is forwarded to FinCEN, which moves quickly to track and recover the funds.

Para obtener más información sobre las estafas de BEC y el fraude romántico, consulte el Asesor FinCEN de julio de 2019 , el Informe de análisis de tendencias financieras FinCEN de julio de 2019 y el Anuncio de servicio público del FBI IC3 .